It Will All Hit the Fan in 2007, Part 1

October 17, 2005 is a day that will live in infamy.

Something happened on that day that bodes ill for the U.S. economy. Most people didn’t notice, but it will have huge implications in the near future:

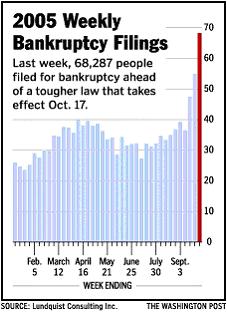

Federal bankruptcy laws changed, making it more difficult for individuals to file for Chapter 7 bankruptcy protection (which eliminates people’s debt).

A bunch of people tried to beat the deadline and filed bankruptcy before the new law took effect.

Why was this an important event?

Consumer debt is skyrocketing in our country: mortgage debt, home equity loans, car loans, credit cards. People have been extracting equity from their homes and spending it like sailors on leave; buying cars, boats, Jacuzzi tubs, fancy vacations, plasma TVs and stainless-steel kitchen appliances.

Now, when people run into financial trouble, they won’t have an easy way out. They’ll actually have to (gasp!) pay back their debts.

I think the change was the right thing to do. Hopefully, it'll be much more difficult for the perpetually undisciplined to skip out on their financial obligations while allowing Chapter 7 bankruptcy for those who are truly in need.

Unfortunately, the timing was terrible.

In Part 2, I will tell you about something else that happened in 2005 and how these seemingly minor events may have ominous overtones for our economy.

0 Comments:

Post a Comment

<< Home